Todd Radwick, DIA, Principal

About Todd

Todd specializes in helping professionals and business owners to plan for their future financial security, with more guarantees and peace-of-mind in life, whether they live long into their reirement years, die prematurely, or get disabled and unable to earn a living along the way. Todd uses a powerful system called "Financial Needs Analysis" to help his clients review and evaluate their financial goals and objectives to discover any detrimental shortfalls that might exist and help them to decide on the best course of action to address them. Many people find this planning process to be invaluable.

Todd's benchmark of success is not measured on whether someone ACTS on his professional recommendations and purchases insurance or investments he may offer. It is measured by how well he feels he has informed and educated his clients on the risks of life and the options and solutions available to them to make well-informed decisions.

Todd comes from a family of insurance and financial professionals.Todd followed his father's footsteps into the life insurance business in January of 1995 by joining as an agent with the New York Life Insurance Company and was there for 12 years. In order to help his clients with more variety and options, he later formed Radwick Financial Group, LLC and has been in the profession now for 30 years. Todd and Radwick Financial Group, LLC are licensed in multiple states across the nation and he does all of his work via phone web meetings.

Todd's main focus is on TAX-FREE and guaranteed life income retirement planning with guaranteed ZERO downside market loss and helping his clients to protect their income in the event the become too sick or hurt to work. Todd has his "DIA" professional deignation, (Disability Income Associate) from AHIP and has been a platform speaker at numerous industry meetings and conferences. He is also a published author with his own financial column in several publications including the Spokane Journal of Business, the Wenatchee Business World, the O&P Business News and the national industry magazine, Broker World.

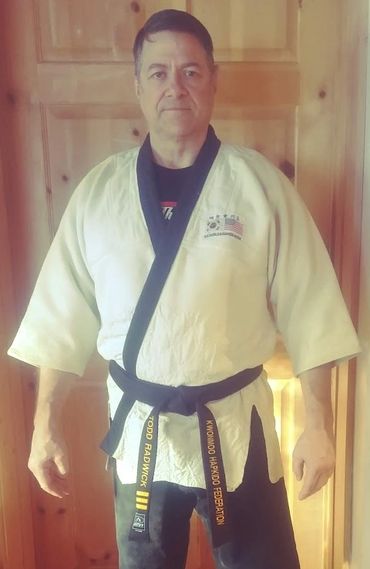

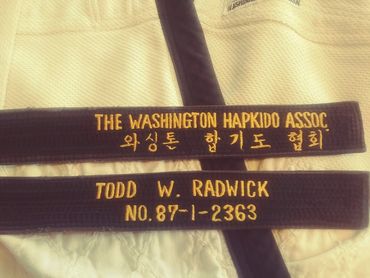

Todd is a former Deputy Sheriff in the state of Washington and currently holds a 3rd Degree Black Belt in the Korean martial art of "Hapkido." Todd has been with his wife and high-school sweetheart for 43 years and has two adult children. He lives in the beautiful Methow Valley in north central Washington where he enjoys working out, hiking, and cross country skiing. https://methowtrails.org/

Call Todd today to leverage his expertise and experience!

- Financial Needs Analysis

- Tax-Free Retirement Planning

- Guaranteed ZERO market loss

- Guaranteed Life Income (similar to pensions)

- Life Insurance

- Disability Insurance

- Long Term Care

- Annuities

- Traditional & Roth IRAs

- 401K Rollovers

- LIRPs (Life Insurance Retirement Plan)

- Business Overhead Expense Protection

- Partnership Buy/Out Insurance

- Key Person Protection

- Customized Bonus Planning (CBP)

Law Enforcement to Life Insurance! Todd protected the public from CRIME. For 30+ years, he has protected his client's loved ones and their MONEY!

What makes us different?

DISABILITY INCOME PROTECTION

Paycheck protection, protecting your income with disability insurance - IS the single most critically important aspect of financial planning and risk management, yet almost always the most overlooked. Advisors who see it this way are RARE. We SPECIALIZE in protecting your EARNED INCOME - YOUR GREATEST ASSET!

LIFE INSURANCE

WE LOVE LIFE INSURANCE which is the sincerest love letter ever written. When someone buys life insurance, it says a lot about their CHARACTER because they truly love others and are happy to step up to the plate to protect them. Todd started at New York Life where he focused on life insurance for 12 years and the passion to help you protect your loved ones is still here.

WE SPECIALIZE IN GUARANTEES

Guarantees in life DO exist - they just aren't "FREE." Nothing worthwhile in life is. Some will say "there are no guarantees in life," or "the only thing in life that is guaranteed is death and taxes." What is more accurate is "There is no such thing as a free lunch." With strong, top life insurance and annuity companies with "A+" ratings for claims-paying ability and financial strength, there ARE guarantees in life! You just need to PAY for them.

- GUARANTEED ZERO market losses

- GUARANTEED PENSION life income

- GUARANTEED life insurance protection

- GUARANTEED Disability Income Protection

TAX-FREE RETIREMENT PLANNING

Our national debt is totally out of control and the interest alone is expected to exceed our entire military budget in 2025. Social security, medicare and medicaid are seriouisly underfunded. We are in historically in a low tax bracket, the highest being 37%. When Ronald Reagan was an actor, anyone making more than $200,000 per year was in a 94% tax bracket. TAXES MUST GO UP. Therefore, making as much of your retirement income tax-free will be of utmost importance. This is our focus - our passion our expertise to help you get there.

WE ARE NOT A "FEE-BASED MODEL" - HOW DO WE GET PAID?

Brokerage Arrangements: If we chose to be a "fee based" model like many other financial advisers and planners, we could and would charge an hourly fee of $500 per hour. Instead, We have chosen not to be "fee based" at this time, and get compensated directly via the various A+ rated insurance & annuity carriers we broker with. This is a "WIN-WIN," no fees for you - more business and referrals and introductions for us.

30 YEAR TENURE - NOT OUR FIRST RODEO

The insurance and financial services and advisor industry is a very tough business and most do not make it over the long term. We are proud our 30+ year history of successfully helping others to sleep well and be more financially secure.

CREDIBILITY - WE ARE PUBLISHED

Todd Radwick is a published author and financial columnist in several business and financial publications including Broker World, The Spokane Journal of Business, The Wenatchee Business World, The O&P Business News (Orthotics & Prosthetics) and others. He is also sought after public speaker at forums and conferences.

OVER 60 CLIENT TESTIMONIALS

See our many compelling client testimonials from happy clients who put it in writing they have never had a single market loss in addition to being thrilled with the value and customer service we bring to the table. The vast majority of other advisors, agents, and planners have no where near this many testimonials. Would you write a testimonial like this for YOUR current advisor and be willing to back it up with your contact info? If not, let's talk.

Our Code of Ethics

Things we live by in everything we do.....

- To always put YOUR needs FIRST! This is all about YOU.

- To ask the right qustions and focus on listening and hearing what you have to say and less on talking.

- To never "SELL" you anything. We hate that word. Instead, we are here to HELP YOU, working with you, collaboratively as a team, to be your advocate as you evaluate all your options.

- Unless it is absolutely obvious to both of us, to never make plannning recommendations on the first meeting. We want to give your case the time and respect it deserves before coming back to you with some options.

- To be prompt and prepared at all or appointments and keep you informed of any delays or changes.

- To promptly return all your calls, texts or messages at our earliest opportunity.

- To keep you informed and abreast of anything we feel might be prudent in the planning of your future financial security.

- To do client reviews at least annually, more if necessary to keep your planning up to date and in allignment with your goals and objectives.

Our Partners