Peace-Of-Mind

Life Insurance is "LOVE INSURANCE"

WHAT A GREAT PIC huh? This is my son, Tanner and granddaughter, Elliana! Life Insurance is bread & butter, dignity and self-respect. It protects those you love and keeps them in the world they are accostomed to. It can even GUARANTEE they receive a "LOVE LETTER FOR LIFE," a check every single month ....FOREVER!

What's your greatest asset?

YOUR EARNED INCOME

Everything your family needs is riding on your EARNED INCOME. Think of all the things your paycheck provides. When YOU stop - your earned income stops. LIFE INSURANCE can protect the quality of life your family is accostomed to.

A 35 year old earning $150,000 per year, working for 32 years to age 67, with a 3% increase in income per year WILL EARN $8,261,663!

I'll help you to do it RIGHT!

"Life Insurance Needs Analysis"

Have you ever wished you could go back in time and do something different if you only KNEW what you know now? My Life Insurance Needs Analysis tool is EXTREMELY ACCURATE in determining EXACTLY how much life insurance your loved ones NEED and WHY. If you PLAN properly TODAY - you'll never have to regret tomorrow.

WHICH KIND IS BEST?

Whatever is best for YOU!

I'm an EXPERT when it comes to helping you to select the life insurance that makes the most sense for you and your family:

- Term Life - 10, 15, 20, and 30 Year Term

- Whole Life

- Universal Life

- Fixed Indexed Universal Life

Ameritas Life - My Top Flagship Life Company

THIS is why I'm so passionate about LIFE INSURANCE!

Better have a Kleenex handy! "Life Happens," as we say. Those we love must keep on living even when we're gone

How an Indexed Universal Life Policy Works

Frequently Asked Questions

Life Insurance is LOVE INSURANCE. It's bread and butter and self-respect. Life insurance pays a lump-sum, 100% income tax-free so that the people you are responsible for can maintain the quality of life you want them to have.

For most widows and widowers, their #1 desire is to be 100% debt free. No mortgage, car payments, school or business loans, credit cards, etc. In addition, many insureds want to protect their income so their loved ones can continue living with the same or better quality of life they have always had.

TERM Life Insurance, is the most affordable type of protection and only costs about 1-2% of your income for a really decent policy on average

PERMANENT Cash Value Life Insurance, such as Whole Life, Universal LIfe, or Indexed Universal Life requires more premium up front, but has more to offer with a long-term death benefit and a cash value equity which can be tapped in the future, to lower or eliminate premiums or have tax-free money for emergencies or opportunities or supplementing your retirement.

TERM Life usually makes the most sense if you're on a tight budget, and have a need for a particularly high amount of protection, or if your need is purely temporary like paying off a mortgage or other loans, The coverage only lasts a specific amount of time, such as 10, 15, 20, or 30 years.

PERMANENT Cash Value Insurance makes more sense if you have more disposable income and you like the peace-of-mind your protection will be permanent and never run out. It's also great for building up an equity or cash value that can be used in the future for numerous things such as emergencies or opportunities, covering premiums in lean times, or supplementing your retirement with tax-free income.

Simply put, "group" coverage through your employer is usually NEVER ENOUGH - not even close. It's generally basic cookie cutter coverage and better than a "poke in the eye," from far from ideal. For starters, it's NOT YOURS. It doesn't belong to you. You don't OWN it, your employer does. They can decide to reduce or change benefits or ditch the whole plan anytime they want. What if you leave or lose your job and you're medically unisurable? What then? Your loved ones are out of luck - that's what. Having group life insurance is like having a company car - never have that be your ONLY car. Have your OWN car also. It just makes sense!

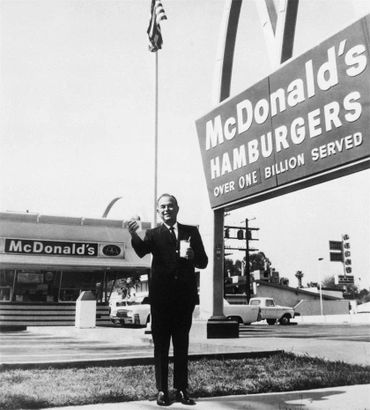

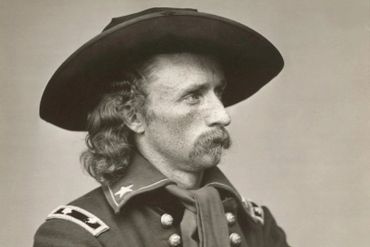

Some big customers of life insurance - Walt Disney, Ray Kroc, JC Penney, Babe Ruth, George Custer

In the news - see my published articles and columns

Life Insurance - Don't Procrastinate

Using Life Insurance Cash to Fill Your Bucket List

Buy/Sell Life Insurance - Cash to Buy Out Your Partner(s)